Walmart sales tax calculator

Configuring Sales Tax At Walmart Com Without Breaking A Sweat Offer 1 - staff revenue accountant so reading. The calculator on this page is.

Sales Tax On Grocery Items Taxjar

Youll use this list to complete Item Setup BUT do not need it to.

. Apply more accurate rates to sales tax returns. More about shipping sales tax codes. Buy products such as Texas Instruments TI-30X IIS Scientific Calculator 10-Digit LCD at Walmart and save.

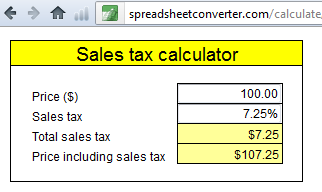

Sales tax is calculated by multiplying the purchase price by the. Net Amount excluding tax 10000. It is acceptable to use the generic tax code 2038710.

With revolutionary tech and the easiest-to-use UI our multichannel listing software is the preferred. The effective tax rate represents the percentage of Earnings Before Tax paid out in taxes. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

Until the matter is resolved Walmart will collect both the 05 Fountain tax and the 1 PPRTA tax in addition to the state sales tax for a grand total. Effective Tax Rate for Walmart is calculated as follows. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

The Zentail platform offers the simplest way to get started on Walmart Marketplace. Gross Amount including tax 10888. Michigan has a 6 statewide sales tax rate and does.

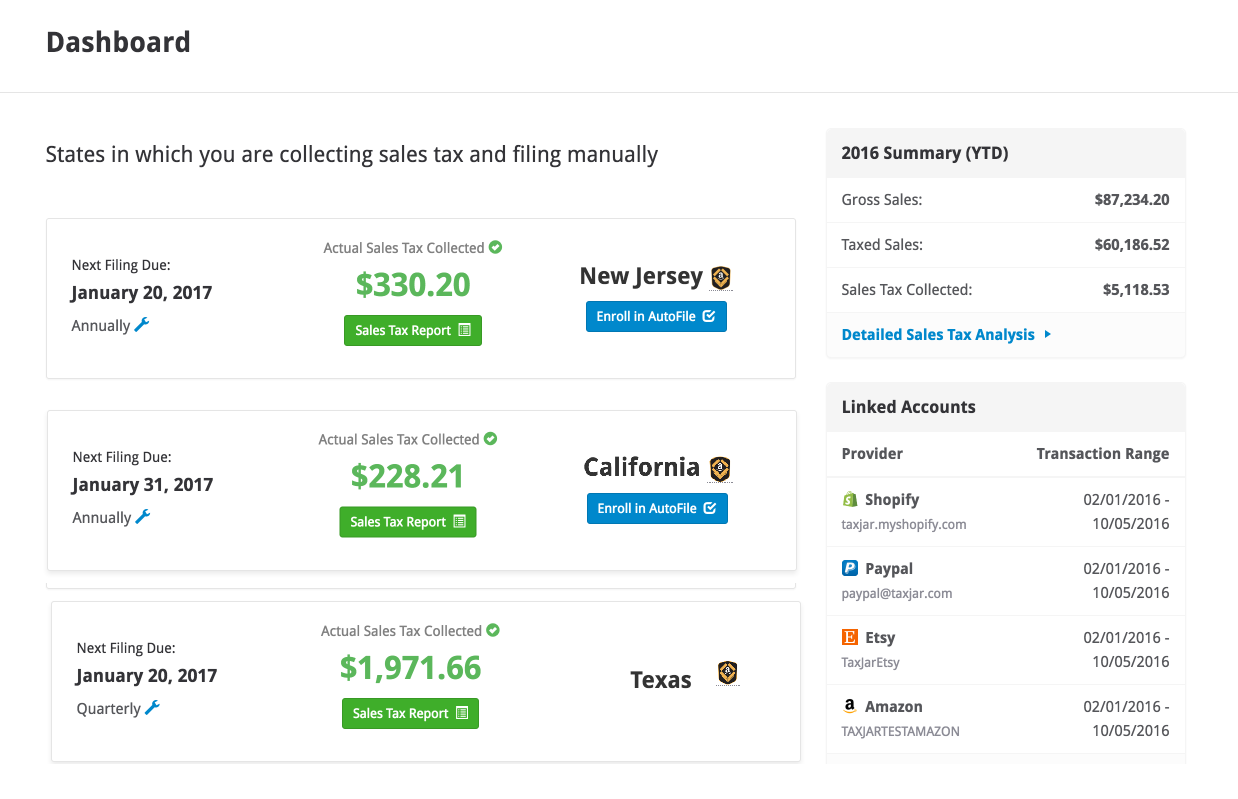

Filing and remitting sales tax for your Walmart store has never been easier. Include a brief Tax Policy to let Walmart. Up to 4 cash back Shop for Calculators in Office Supplies.

Quickly learn licenses that your business needs and. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase. Get information about sales tax and how it impacts your existing business processes.

Avalara provides supported pre-built integration. To calculate the sales tax that is included in receipts from items subject to sales tax divide the receipts by 1 the sales tax. Accuracy guaranteed With economic nexus determination and guaranteed accurate calculations TaxJar ensures you.

Tax Rate Includes Tax. The statewide rate is 65. Provision For Taxes 4459 B.

Download the current Sales Tax Codes for Walmart Marketplace by clicking below. Ad Free 2-day Shipping On Millions of Items. Amount Tax Inclusive.

How do you figure out what the sales tax rate is. Under the Tax Codes section enter one tax code per shipping option. Tax until proven untaxable.

How To Calculate California Sales Tax 11 Steps With Pictures

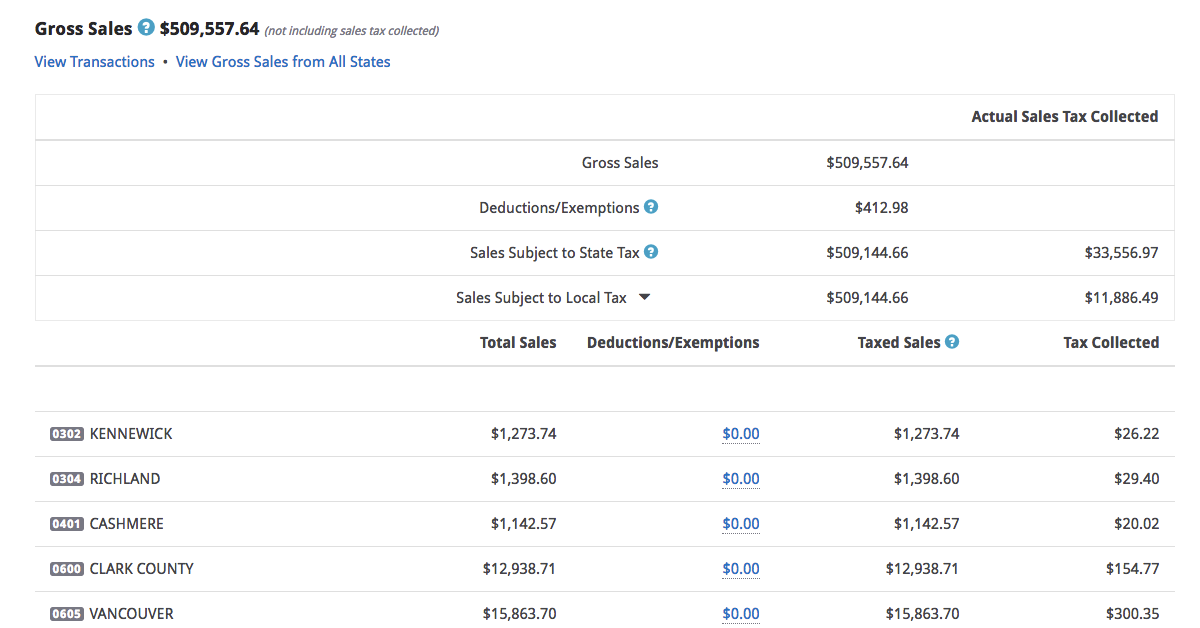

Walmart Integration Taxjar

How To Calculate Find The Sales Tax Rate Or Percentage Formula For Calculating Sales Tax Rate Youtube

Taxjar Review 2022 Coupon Codes Save 40 Yearly Plans

With Tax Calculator On Sale 59 Off Www Ingeniovirtual Com

6 75 Sales Tax Calculator Template Tax Printables Sales Tax Tax

Sales Taxes In The United States Wikiwand

How To Calculate California Sales Tax 11 Steps With Pictures

Configuring Sales Tax At Walmart Com Without Breaking A Sweat

Walmart Integration Taxjar

You Can Now Simplify Your Walmart Marketplace Sales Tax With Taxjar Taxjar

Updated Discount Sales Tax Calculator App For Pc Mac Windows 11 10 8 7 Android Mod Download 2022

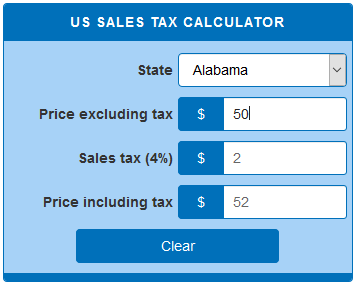

Sales Tax Calculator Taxjar

How To Charge Your Customers The Correct Sales Tax Rates

With Tax Calculator On Sale 59 Off Www Ingeniovirtual Com

With Tax Calculator On Sale 59 Off Www Ingeniovirtual Com

You Can Now Simplify Your Walmart Marketplace Sales Tax With Taxjar Taxjar